Improving ATM Security with AI Dwell Time

As the banking industry becomes digital and self-service oriented (including ATMs or Automated Teller Machines) the need of a high level security cannot be neglected.

As the banking industry becomes digital and self-service oriented (including ATMs or Automated Teller Machines) the need of a high level security cannot be neglected. As more customers rely on ATMs for daily transactions, these machines have become not only convenient access points but also potential targets for fraud, tampering, and criminal behavior. This growing risk underscores the importance of implementing smarter, more adaptive security systems that can respond in real time to unusual activity.

Conventional CCTV systems are useful, but they can be inadequate when it comes to detecting threats and suspicious activity in advance. It is here that AI Dwell Time technology is revolutionizing the arena of ATM security.

What Is AI Dwell Time?

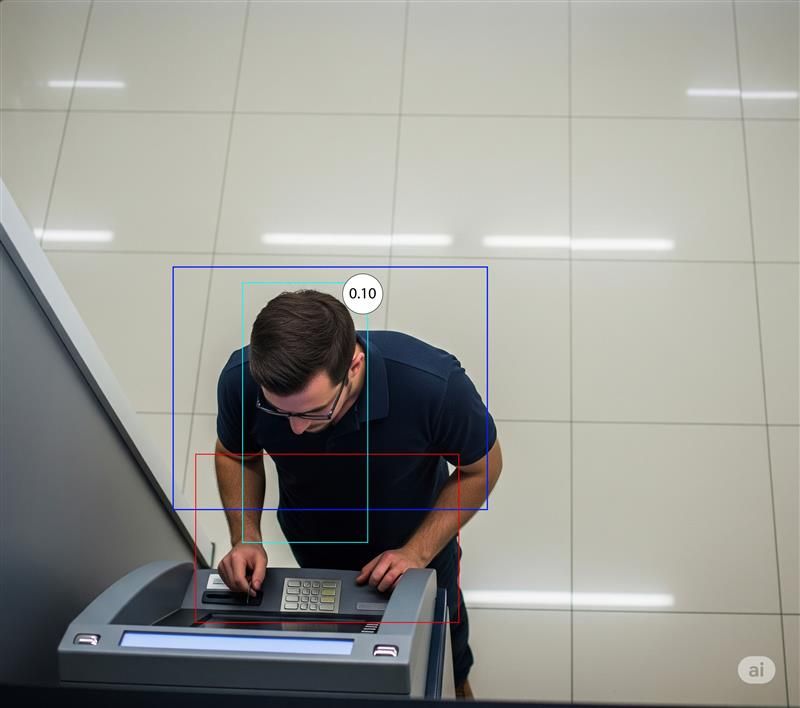

AI Dwell Time refers to the use of artificial intelligence to track how long an individual stays in front of an ATM. By recording start and end times of a person’s presence, the system calculates how long the user interacts or loiters at the machine. This data is then analyzed to detect unusual behavior and improve service efficiency.

Unlike simple motion sensors, AI-powered systems continuously learn from human behavior and transaction patterns, making them far more accurate and responsive.

See also: Safety and Management with AI-Powered Hall Crowd Monitoring

How It Works?

When a customer approaches an ATM, AI software automatically records the start time, recognizing the moment the individual enters the monitored area. Using computer vision technology, the system tracks the user’s presence and interactions without needing direct input.

Once the person completes a transaction and walks away, the AI logs the end time, calculating the precise dwell duration, the total time spent at the ATM. This automated process happens in real time, allowing for both behavioral analysis and immediate system responses when necessary.

Multiple Uses of AI Dwell Time Data

1. Security Monitoring

If someone remains near an ATM for an unusually long period without performing a transaction, it may signal suspicious intent such as card skimming, physical tampering, or surveillance for theft.

2. Operational Analysis

The data can also be used to evaluate the efficiency of ATM services. If multiple customers consistently spend longer than average at a specific machine, the issue may stem from slow interfaces, confusing menus, or hardware problems.

3. Real-Time Alerts

The system can also be configured to send an alert when a transaction is completed. This adds another layer of situational awareness especially useful in locations with higher security risks or during off-peak hours.

Why AI Dwell Time Matters for ATM Security

In addition to enhanced protection, AI Dwell Time provides insights that help optimize ATM performance and customer experience.

1. Transaction Efficiency Monitoring

By analyzing dwell time trends across various machines and locations, banks can identify slow-performing ATMs and take corrective actions, be it software upgrades, better UI, or hardware replacement.

2. Peak Hour Mapping

AI can reveal high-traffic periods, allowing for better cash refills, maintenance scheduling, and even targeted marketing.

3. Customer Behavior Analytics

AI helps distinguish between regular ATM users and potentially fraudulent behavior, allowing security teams to prioritize threats intelligently.

4. Enhancing Customer Experience

By reducing fraudulent transactions and theft, customers benefit from safer and more reliable ATM services.

5. Cost-Effectiveness

Automating ATM monitoring with AI reduces the need for extensive human surveillance and manual inspection.

6. Scalability

AI systems can monitor thousands of ATMs simultaneously, making it ideal for banks with widespread networks.

East Integration with Existing Systems

One of the strengths of modern AI Dwell Time systems is their seamless integration with existing CCTV infrastructure, allowing financial institutions to enhance surveillance without replacing legacy setups. AssistX Vision builds on this capability by enabling behavior-based monitoring and AI-driven video analysis using standard hardware, providing deeper visibility into ATM activity and supporting anomaly detection with minimal infrastructure changes.

See also: CCTV Transformation Through AI-Powered Technology: Revolutionizing Surveillance

Automated Compliance Monitoring

In regulated environments, banks are often required to log and report ATM performance metrics, especially around customer experience and uptime. AI Dwell Time provides automated data collection and reporting tools that simplify compliance tracking. With detailed logs on transaction durations and anomalies, banks can demonstrate adherence to Service Level Agreements (SLAs) and reduce the administrative burden of manual reporting, lowering regulatory risk while maintaining transparency.

AssistX Vision complements this need by helping institutions manage and access performance data more efficiently through a centralized dashboard, enhancing both audit readiness and operational oversight without the need to duplicate existing monitoring systems.

AssistX: Scalable AI for ATM Security

AssistX Enterprise provides one of the most complete AI Dwell Time monitoring solutions on the market. Through its AssistX Vision platform, the system records entry and exit times at ATMs, calculates dwell duration, detects abnormal delays, and sends alerts when necessary. It also supports post-transaction notifications, enabling centralized response to high-risk cases.

Final Thoughts

AI Dwell Time is revolutionizing the way banks secure and optimize their ATM networks. By transforming passive monitoring into real-time, data-driven insights, financial institutions can better protect customers, reduce fraud, and improve operational efficiency.

And with partners like AssistX Enterprise, banks gain access to an integrated suite of tools combining AI video analytics, smart surveillance, and bandwidth-efficient infrastructure that empower the future of self-service banking.

Related article: CCTV Transformation Through AI-Powered Technology: Revolutionizing Surveillance